Fall Mortgage Rate Analysis

It was an eventful summer for U.S. financial markets, and that has had a significant impact on mortgage rates for this fall.

With that in mind, I thought I’d send over a helpful overview of what current and prospective homeowners need to know about rising interest rates, mortgages, and the housing market in general.

Federal Reserve & Mortgages

As you may know, when the U.S. Federal Reserve raises interest rates, mortgage rates usually increase as well. However, nobody knows how high interest rates will go or for how long they will rise.

In a recent gathering of central bankers from around the world in Jackson Hole, Wyoming, Federal Reserve members indicated that higher interest rates will continue into the near future at the very least, as the battle against inflation continues.

In fact, Federal Reserve Chair Jerome Powell said that the central bank will “use our tools forcefully” to attack inflation and that higher interest rates will persist for “some time.”

Have Mortgage Rates Hit Their Peak?

Industry analysts are offering varied perspectives regarding the future of mortgage rates amid rising interest rates.

Lawrence Yun, chief economist at the National Association of Realtors (NAR), chimed in recently: “The peak in mortgage rates for this year may have already occurred in the middle of June at nearly 6%. There was an overshooting of rates at that time in an uncertain inflationary environment. Now, with gas prices steadily retreating, consumer price inflation may also have already peaked. That means the 30-year mortgage rate could settle down at around 5.5% for the remainder of the year.”

Others offered different opinions.

• Freddie Mac forecasted the 30-year fixed mortgage averaging 5% in 2022.

• Danielle Hale, chief economist at Realtor.com, says: “For mortgage rates, we’re likely to see upward pressure with much less intensity. Mortgage rates are currently near 5.5%, and I expect them to hover between 5.5% and 6% between now and the end of 2022.”

It is important to note that these estimates were published prior to Federal Reserve Chair Jerome Powell’s hawkish post-Jackson Hole commentary. I’ll continue to pay close attention to commentary about mortgage rates as Fed actions and rhetoric develop.

“Real” Mortgage Rates

Unquestionably, mortgage rates have risen from their historically low levels of 2020-2021. However, rates may actually be better than they seem when factoring in the inflation rate.

Consider what some economists call the “real interest rate.” Leveraging this thought process, if inflation is 8.5% and the average 30-year fixed mortgage is 6.0%, the “real” mortgage rate is a negative 2.5%.

There is some merit to this type of analysis. If “things” cost 8.5% more than they did a year ago, and money can be borrowed at 6.0% or so, one could say that borrowing costs are low, relative to the price of “things.”

Of course, inflation will not remain at these elevated levels forever, and a 30-year fixed mortgage rate will remain the same for, well, 30 years. With that in mind, a smart homebuyer may want to lock in a mortgage given current levels of inflation and plan to refinance once both inflation and rates go down.

Real Estate Market: Reasons for Optimism

With a recent report by the National Association of Realtors showing an existing home sales decline of 5.9% year-over-year, many analysts are starting to call the present real estate landscape a “recession in sales, but not prices.”

However, if you are in the market as a buyer, the autumn season could give you a few reasons for optimism. Markets nationwide appear to be in a rebalancing period. Active listings increased year-over-year by 26.6%, showing many markets nearing a more “normal” landscape, a welcome sign for buyers.

For much of the summer, pricing has remained firm despite rising inventory, with 40% of homes commanding the full list price. However, just recently, the average home began to sell below asking price for the first time since March 2021, according to Redfin.

Putting It All Together

It may seem like a complex landscape right now to those who have not experienced rising interest rates before. But cycles play out, and it takes time for that to happen.

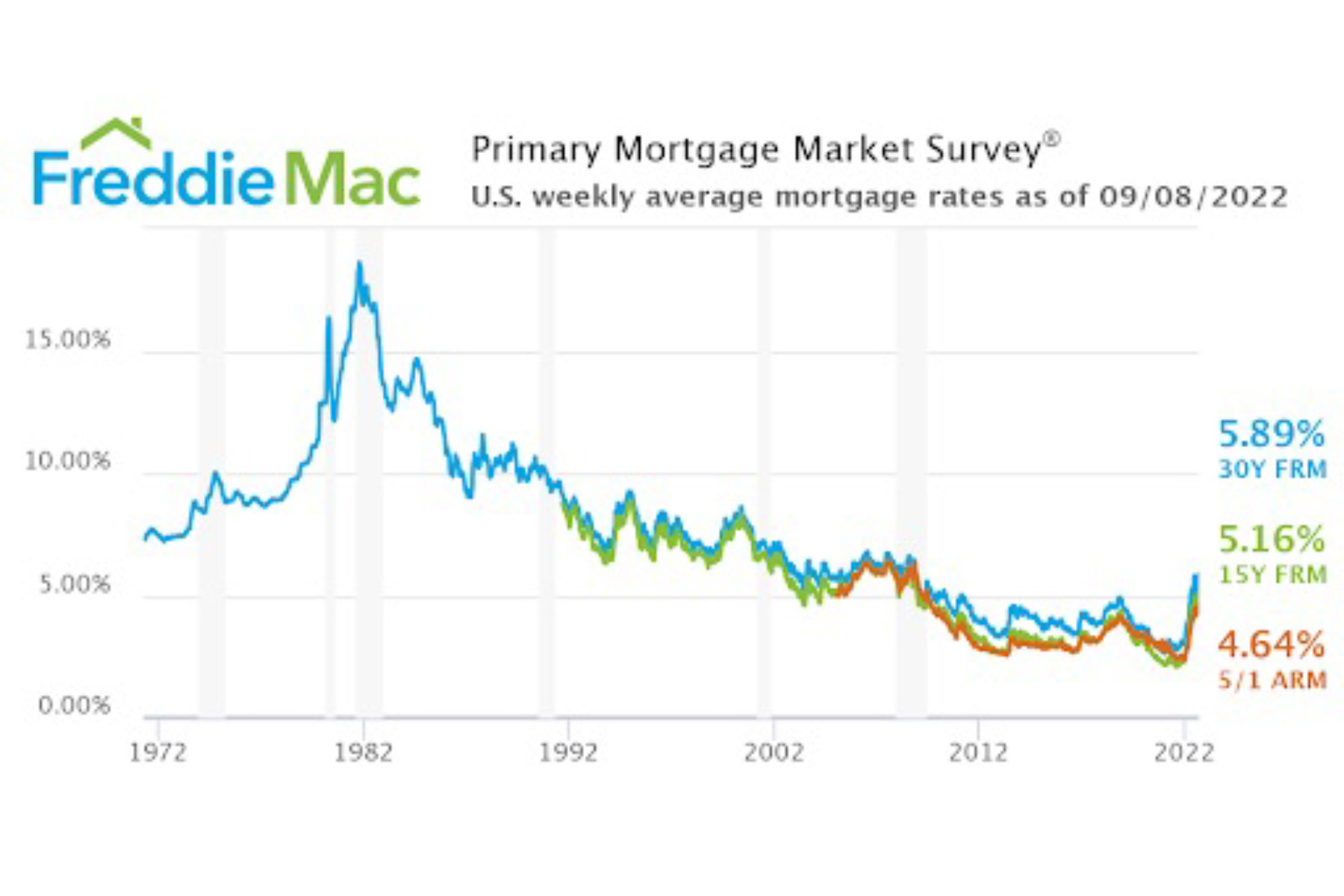

Additionally, it’s worth noting rates are still historically low. I know it does not feel like it, but just take a look at the historical data below. Many of us are too young to know what it was like to take out a mortgage at rates in excess of 15%, as was standard in the early 1980s. Rates have been – and can go – much higher.

Source: Freddie Mac, Primary Mortgage Market Survey 04/02/71 – 09/08/22. U.S. weekly averages. https://www.freddiemac.com/pmms